In Part 1 of this series, we introduced the Federal Acquisition Regulation’s (FAR) approach to insurance and risk allocation in federal procurement, focusing on FAR Part 28 and the insurance-related…

Subscribe & Connect

The Latest

When Federal Contracts Meet Insurance Coverage – Part 2: Automobile Liability Under FAR 52.228-8 and FAR 52.228-10

In Part 1 of this series, we introduced the Federal Acquisition Regulation’s (FAR) approach to insurance and risk allocation in federal procurement, with a focus on FAR Part 28 and…

Relationship Limits: 11th Circuit Reins in Scope of “Relating To” in Insurance Policy Exclusions

Insurers often rely on introductory phrases in exclusions, such as the phrase “relating to,” to expand the scope of exclusions beyond all reasonable bounds. The Eleventh Circuit recently reaffirmed that…

The Eleventh Circuit’s recent decision in L. Squared Industries, Inc. v. Nautilus Insurance Co. offers important guidance for policyholders navigating notice provisions under claims-made insurance policies—particularly when a policy imposes…

Insurance coverage disputes often rise or fall on sweeping questions — trigger theories, allocation frameworks, priority of coverage. But sometimes the battle comes down to something dramatically smaller: a comma.

The Federal Acquisition Regulation (FAR) is a comprehensive set of regulations governing federal procurement — prescribing how agencies acquire goods and services and how contractors compete for, win, and perform…

New Allegations Trigger Insurance Coverage Despite “Prior Knowledge” and “Prior and Pending Litigation” Exclusions

A recent coverage decision by the Delaware Superior Court in Motive Technologies, Inc. v. Associated Industries Insurance Company shows that examining the full timeline of allegations in a lawsuit can…

Beware of State Insurance Requirements for Non-Physician Healthcare Providers

Healthcare providers face a patchwork of state laws and regulations requiring certain types and amounts of liability insurance. Although all healthcare professionals should procure policies covering alleged negligence in healthcare…

Three Steps to Protect Your Insurance Program During National Preparedness Month

September is National Preparedness Month in the United States. This designation urges organizations and individuals to prepare for disasters and emergencies. Given the increasing frequency and severity of natural disasters…

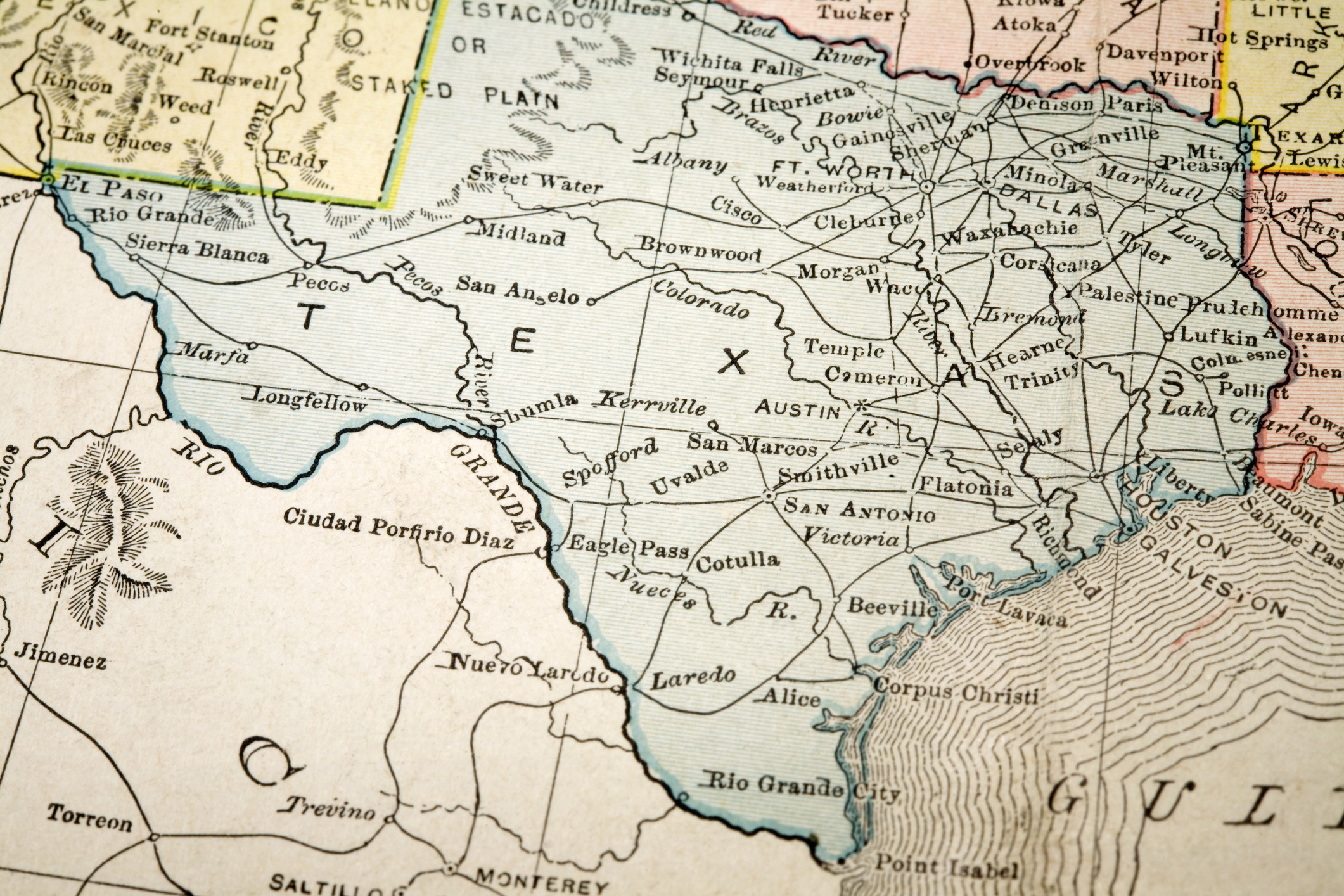

Texas Court Exposes Key Gap in Professional Liability Coverage for Home Health Franchisors

In the home health care business? Whether a franchisor, franchisee, or independent agency, beware of bodily injury exclusions in professional liability policies that could eliminate coverage for otherwise covered claims.…